What is Considered Income for Spousal Support?

If you’re like many people going through a divorce in California, you need to know what is considered income for spousal support. That’s true whether you’re likely to have to pay spousal support (commonly called alimony) or whether you’re likely to receive it.

Usually, the court awards alimony to the lower-earning spouse. It’s a way to level the playing field so that the lower earner has time to get on his or her feet and become completely self-sufficient.

When a judge awards spousal support, he or she must consider the paying spouse’s income.

But what is considered income for spousal support? Here’s what you need to know.

Related: If I get remarried, do I still have to pay alimony?

What is Considered Income for Spousal Support?

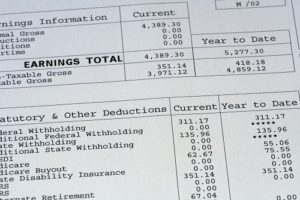

Income for spousal support includes all sources of money that a person receives, whether it’s through a paycheck, through stock dividends or through another source. Generally, everything that you’d pay income tax on when it’s time to make a payment to the IRS counts as your income.

Related: Typical alimony payments in California

What About Imputed Income?

If the person who is supposed to pay spousal support is working a job that pays less than what he or she could earn – especially if the person is doing it purposefully to avoid paying spousal support or child support – the courts can figure out an amount based on a higher figure. That’s known as imputing income for support, and it means that the court will attribute income to a person who hasn’t actually earned it.

Here’s another example: Your ex has been earning $90,000 per year in a long-term job. However, that job requires a lot of travel. Your ex quits and takes another job making just half of his or her previous salary – and then says that spousal support is unaffordable. The judge in your case will want to know why your ex quit the stable, long-term job, and you’ll have a chance to explain that it was completely voluntary. In a case like that, the judge could impute income, resulting in a spousal support payment comparable to what you’d receive if your ex still had the $900-per-year job.

Related: What is temporary spousal support in California?

A Word on Spousal Support AS Income

When someone receives spousal support, he or she must count it as income when filing federal and state tax returns. According to the IRS, alimony needs to be included in a person’s income if the two parties involved meet the following conditions:

- The spouses don’t file a joint return with each other

- The payment is in cash (including checks or money orders)

- The payment is to or for a spouse or a former spouse made under a divorce or separation instrument

- The divorce or separation instrument doesn’t designate the payment as not alimony

- The spouses aren’t members of the same household when the payment is made (this requirement applies only if the spouses are legally separated under a decree of divorce or of separate maintenance)

- There’s no liability to make the payment (in cash or property) after the death of the recipient spouse

- The payment isn’t treated as child support or a property settlement

As a side note, if you pay spousal support, the IRS says “Alimony is deductible by the payer spouse.”

Do You Need Legal Advice on What is Considered Income for Spousal Support?

If you need legal advice, such as what is considered income for spousal support, or if you want to find out whether you’ll have to pay – or be entitled to – spousal support, we can help. Call us at (209) 989-4425 or get in touch with us online to schedule your consultation. We’ll help you with every aspect of your divorce, from child custody and child support to property division.